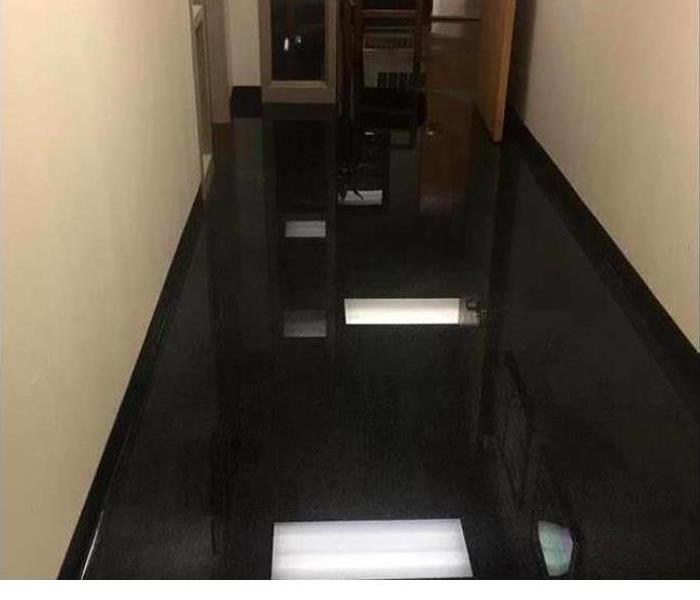

FLOODING - Who is responsible if you are renting?

10/17/2019 (Permalink)

Flood Insurance -

Flood insurance is not commonly included in a standard property policy. You have to add it. Neither is it standard in a renters policy. The insurance can be purchased as a separate policy that requires a waiting period of 30 days before coverage begins.

Landlord's Responsibility -

Landlords are usually responsible for insurance for the property itself. Property protection commonly includes:

- Structural damage

- Appliance replacement

- Fixed Fixtures

- Pipes and things inside the wall

- Restoration to the structure by qualified specialists

Responsibility of Tenants -

The tenants are commonly responsible for an insurance policy that covers personal possessions. If a flood is covered, the renter’s coverage can also include:

- Paid temporary relocation in a comparable home

- General living expenses like food and clothing

- Replacement of personal items affected by the loss

Unusual Circumstances -

Often times landlords are not responsible for the tenant’s property. However, If the property owner is responsible through neglect or irresponsibility, the tenant may have a legal case against the landlord for damages incurred and pursue restitution.

For more tips or if you have questions call SERVPRO of Tarzana/Reseda anytime. 818-881-3636

24/7 Emergency Service

24/7 Emergency Service